Dear Client:

The markets have started to rebound with both the S&P 500 and S&P Global 1200 Indices up more than 19% in the last three weeks of the first quarter. Finally, there are indications that the market may have touched bottom.

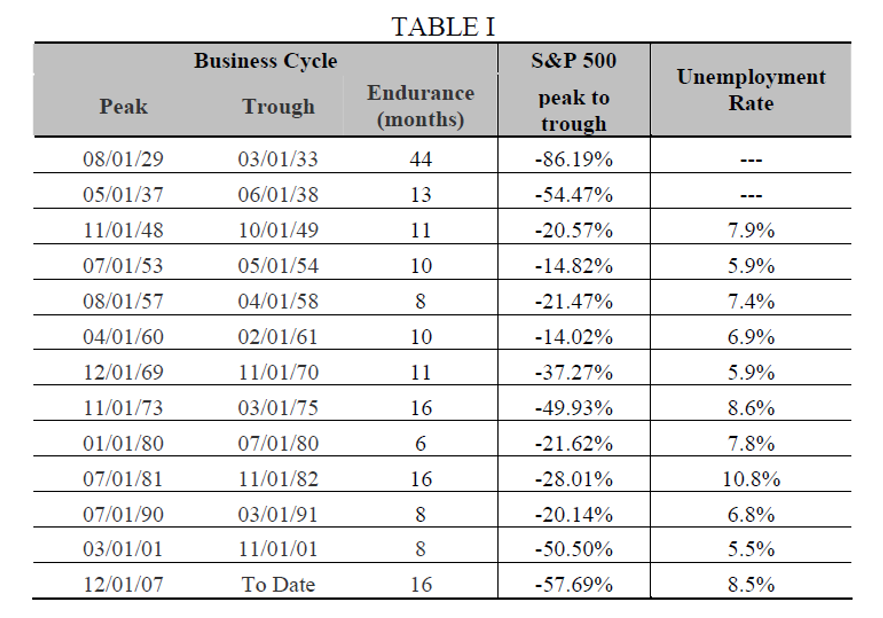

The current recession is one of the most serious in history. Historically, recessions endure thirteen months on average, or eleven months excluding the Great Depression’s forty-four month run. We have been mired in the current recession for sixteen months already, the second longest in history. There has been a loss of more than five million jobs, the highest level since the 1929 Depression. The first quarter will be the seventh straight quarterly drop for U.S. corporate profits, the longest losing stretch since the Great Depression. In terms of the S&P 500 Index, the current downturn of -57.69% from the peak to the recent trough, is the second deepest in history (see Table I).

TABLE I

The U.S. and global economies have undoubtedly suffered and are in worse shape than most could have imagined. The current situation is a once-a-century type of crisis. It has impacted just about everyone globally. With the exception of U.S. Treasuries, all asset classes have declined dramatically and, consequently, “textbook” investment principles such as diversification, asset allocation and long-term investment, have not lessened the sting. As these difficult conditions persist, frustration, doubt and fear occupy the minds of many investors, professional and amateur alike, causing many to abandon their discipline. However, this is exactly the time when focus and discipline is sorely required.

There are a few encouraging signs. With all the money being aggressively pumped into the markets worldwide, the financial system is expected to start working again. Many companies are fighting for survival with lots of changes. As they continue to cut capital expenditures, payrolls and inventories, sales gains should flow quickly to the balance sheets, even as consumers rein in debt and save more. With the exception of the financial sector, companies in general have much stronger balance sheets compared to other recent recessions. One year into this recession, the level of economic activities has been lowered significantly and thus our recovery will begin from a lower base point. This translates into a more favorable comparison than in 2007 and 2008 for performance purposes.

There is also growing demand coming from the emerging markets, such as Brazil, Russia, India and China, each of which have large populations and buying power. In terms of investment, the signs of a recent turnaround globally should help raise investor confidence to a level so that cash sitting on the sidelines and gaining extremely low returns may be deployed into the market again.

There is widespread concern about potential inflation. However, remember that we are still contending with deflation, which could have a greater impact than inflation as corporations and consumers delay capital expenditures and purchases alike. Chart I below shows historical inflation levels since 1990. Without consumption, which accounts for 70% of GDP, asset values across the board and economies are slow to grow. With respect to the billions of dollars that the U.S. government is pumping into the system, there is an expectation that much of it will return to the Fed in the form of investment return once the financial system is working again. This should reduce the pressure of inflation at least for the present (see comments in Fixed-Income Update).

CHART I

Consumer Price Index

There has also been concern among clients about asset allocation being too aggressive. We have worked diligently to “stress-test” our asset allocation. However, any adjustment should be transitioned gradually as the situation improves. When the environment is as bad as we have been experiencing, it is natural to be pessimistic. We should not invest emotionally when the market is so volatile. As Warren Buffett has said, “be fearful when others are greedy; be greedy when others are fearful.”

Sincerely,

Joseph Lai